Creating long-term shareholder wealth – what does it take?

How is long-term shareholder wealth measured, and what drives it? Growth, margins, cash flows, gearing, risk management, etc. How do you best combine these to maximise business value?

A business’ value – and how it changes – is at the heart of management consulting.

For the implementation of strategies to be successful, it must ultimately result in a sustainable increase in company value.

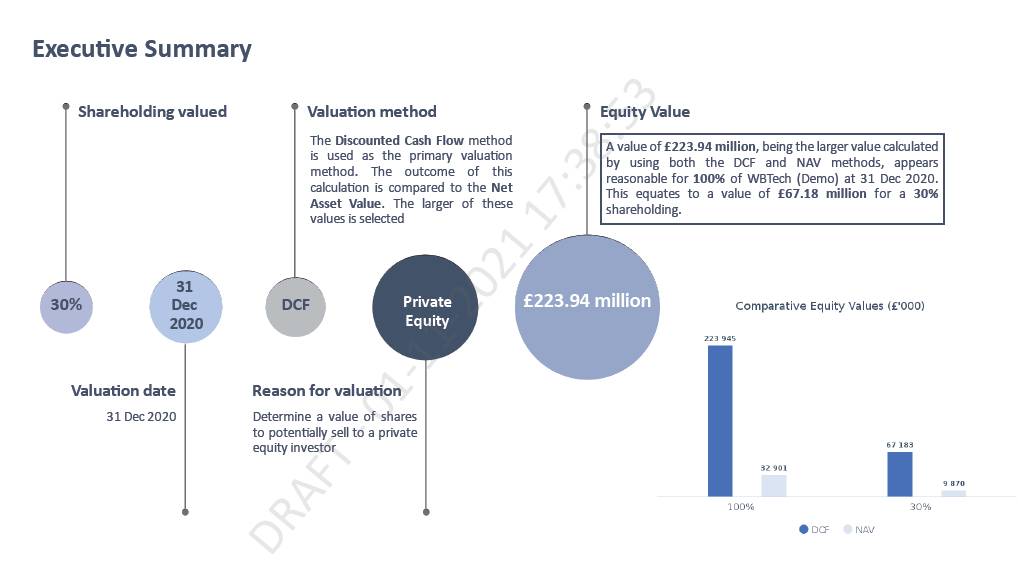

Valuation Services and M&A Support

Consultants like you often require specialised expertise to support your projects’ outcomes. Our Valuation Services offer comprehensive calculations and independent reports, strengthening your projects related to tax planning, asset externalisation, and more. Moreover, our M&A Support can be instrumental in supplementing your efforts, particularly in areas such as financial modelling and intricate analyses, adding depth to your consulting services and enabling more robust project delivery.

Credible online business valuation platform – that saves both time and money

The sheer volume and ongoing requirement for company valuations for different companies and clients, can be overwhelming.

Based on your inputs, Worth.Business creates automated, standardised reports via an intuitive, user-friendly interface.

All at a fraction of the typical time and cost of traditional valuations.