Take the pain out of valuations and portfolio tracking

Is monitoring portfolio value more time-consuming than creating portfolio value? Do you have high volumes of year-end value adjustments?

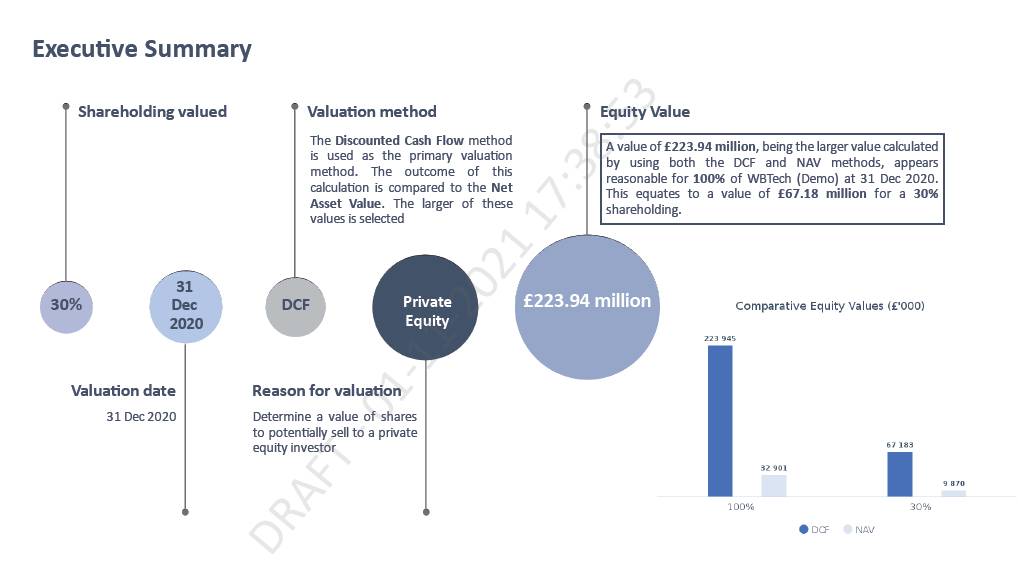

Business valuations are central to the investment process and post-investment monitoring by fund managers.

Whilst the value of listed investments can be tracked on the markets, it requires considerable effort to monitor values of private companies and venture capital investments.

It is time for this process to change – so you can focus your time and energy on maximising returns, not monitoring it.

Valuation Services and M&A Support

Our Valuation Services offer specialised expertise in financial modelling and valuation, augmenting your capacity to manage complex assessments. When your internal resources are strained, we can provide the skills and capacity needed for credible valuations. Furthermore, our M&A Support can assist in optimising your mergers and acquisitions activities. From intricate financial modelling to credible valuations, our expertise can navigate the complexities of the process, ensuring your resources are optimised.

Take control of your time

The number of company valuations required can be overwhelming, especially for private equity, venture capital and seed capital funds.

Worth.Business saves you time by creating automated, standardised reports, subject to your inputs.

Reduce your workload and focus your efforts where it matters most – by managing your portfolio.